Cosa Resources – Summer Drill Program Delineates 2kms Strikelength of Graphitic Faulting And Strong Sandstone Alteration Along The Cyclone Trend At The Murphy Lake North Uranium Project

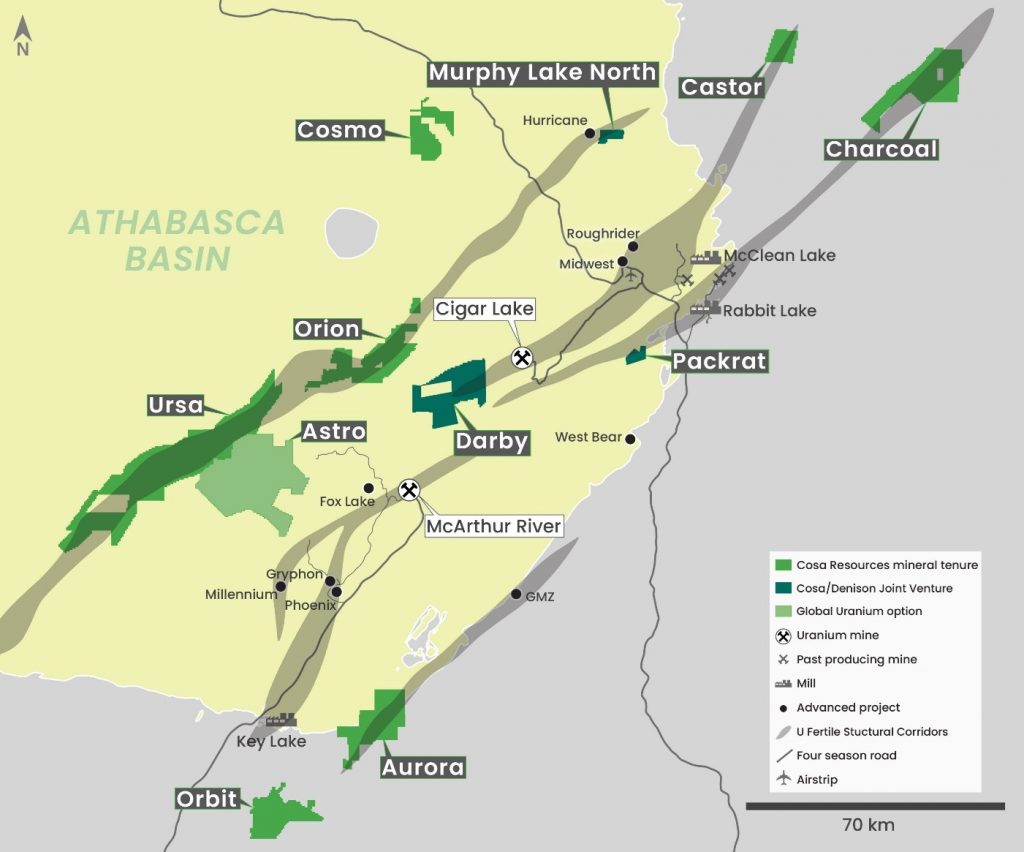

Keith Bodnarchuk, President and CEO, and Andy Carmichael, VP of Exploration of Cosa Resources Corp. (TSXV: COSA) (OTCQB: COSAF) (FSE: SSKU), both join me to review the news released today on August 25th highlighting that the summer exploration drilling has successfully identified two kilometres of highly prospective strike length characterized by strong sandstone alteration and graphitic faulting at the Cyclone Trend on the Murphy Lake North Project (“MLN”). MLN is a joint venture between Cosa and Denison Mines Corp. $DML $DNN.US and is located in the eastern Athabasca Basin, Saskatchewan. Cosa is the project operator and holds a 70% interest with Denison holding a 30% interest.

Summer Drilling Highlights:

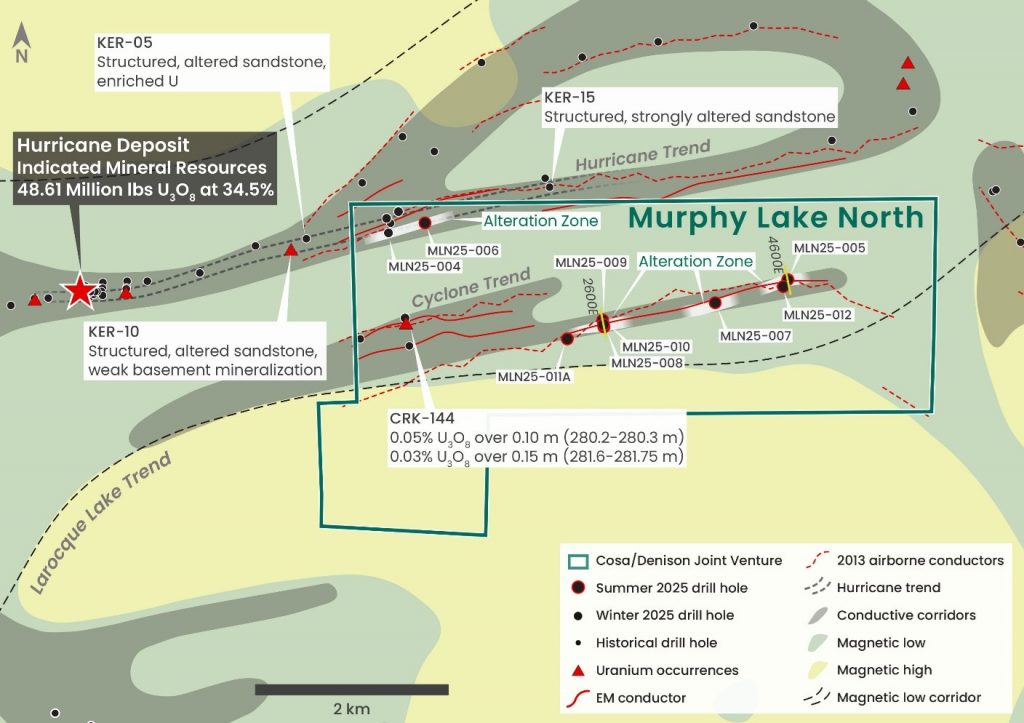

- Two kilometres of strong sandstone structure and alteration identified at the Cyclone trend underlain by large scale graphitic faulting

- Up to 30 metres of unconformity relief identified at Cyclone

- Alteration and structure at Cyclone remain open in both directions and follow up drill targets exist along multiple trends

- Cosa has met its sole-fund obligation and now owns an irrevocable 70% interest in Murphy Lake North

Keith outlines why these results of the Murphy Lake North summer drill program, specifically those at the Cyclone trend, are the most significant to date for Cosa, and further support their thesis and the follow up drill program slated to begin in early 2026.

Andy visually walks us through where the 3,323 metres in eight holes were completed, with one hole being put into the Hurricane trend to follow up winter 2025 drilling results, and then the balance of 7 holes being drilled as the initial reconnaissance of the Cyclone trend. These results identified over two kilometres of highly prospective strike length and potentially identified an additional unexplored parallel trend to the south. The intensity and continuity of sandstone alteration and structure, both vertically and along strike, is an encouraging indicator of the trend’s prospectivity. Basement structures intersected two kilometres apart are textbook examples of major graphitic faults critical to the formation of eastern Athabasca uranium deposits. With an average depth to the unconformity of roughly 250 metres, the Cyclone trend is incredibly well situated for the discovery of relatively shallow mineralization. Andy showcased photos of the drill core, and that they’ll be awaiting the geochemical results, to then vector into to the future follow up drill targets.

Wrapping up we looked ahead to the follow up program for early 2026, where Cosa and Denison elected to leave much of the drill equipment on site to minimize the time and cost to resume early next year. Additionally, Keith mentioned that Darby project, another key property in the Cosa/Denison JV agreement will be getting its first drilling at high-priority targets in 2026.

If you have any questions for Keith or Andy regarding Cosa Resources, then please email them in to me at Shad@kereport.com.

Click here to follow the most recent news from Cosa Resources

.

.

IPT reported disappointing Q2 earnings today. A loss of 2M which is just under a penny a share. Moreover management couldn’t be bothered to include any numbers whatsoever choosing instead to lead with a 27% year over year improvement in Q2 revenues.

Sigh!

Its going to take $40 plus silver for this thing to move. I’m frustrated but holding.

Impact Silver’s earnings were fine, not great, not bad. The $2M loss included exploration expenses and was still $600,000 less than the Q2 2024 loss. And mine operating income improved to $1.0 million, compared to a $1.0 million loss in the same quarter last year. Before amortization and depletion, mine operating income was $1.6 million compared to a $0.2 million loss in Q2 2024.

The real negatives were the following and will be dealt with:

-Weather-related operational disruptions affected Zacualpan production

-Unfavorable ground conditions at Plomosas required additional development work

-Lower grade production at Plomosas due to access limitations

The positives include:

-Revenue increased by 27% to $9.8 million in Q2 2025

-Mine operating income improved to $1.6 million from a $0.2 million loss in Q2 2024

-Strong balance sheet with $10.3 million cash and $13.3 million working capital

-Plomosas production increased 116% YTD

-Direct costs at Plomosas decreased significantly from $400.70/t to $230.14/t

-Silver production increased 2% YTD with lead up 15% and gold up 58%

Price held up well today despite a chart that looks friendly to more corrective action. That’s a good sign. It is still essentially “at the money” which means it still has maximum leverage to the silver price. Those who are new to the stock will like that fact unless they don’t believe silver is going much higher from here.

All true Mathew. Frankly the quarter over quarter comparable that irks isn’t Q2 25 vs. Q2 24. It’s Q1 25’s net loss of 200K (virtually breaking even) compared to Q2 25’s net loss of 2M.

That’s going backwards regardless of how the loss breaks down. The bullish case for IPT today rests a little more on silver upwards into the 40s and a little less on increased operating efficiencies.

And i emphasize ‘today’.

If silver gets to $40 and beyond there are a lot better places to benefit from that. IPT gets very little exposure apart from this site, with constant support from Matthew. He is a one man IPT show.

That lack of exposure is a good thing. I generally avoid companies with big advertising budgets and plenty of exposure/recognition for several reasons. If/when Impact becomes such a company, I will be fading my way out of it.

By all means, keep talking it down to the best of your ability. The more weak hands you can influence the better.

i wouldn’t expect great reports from the company, trading at 25 cents per share. Thank you very much, Matthew, for giving us all the numbers. As always very helpful.

Terry Huebert is wrong about one-man show, because well-known Don Durrett, in his mining comp. ratings said: IPT is a must have stock.

IPT was on Durrett’s list 7 months ago but since then they have diluted and have not been able to turn a profit with the increased silver price.

SCZ is firing on all cylinders.

When it bought those mines from Glencore a few years ago management in effect bet the company.

Today, production is rising, just reported earnings are up and the Glencore debt will be repaid this year ahead of schedule…and all of it timed to take advantage of this epic silver bull run underway.

I’ve been holding for nearly five years and anticipate watching this story unfold for at least one or two more.

Congratulations to all long term shareholders. Our patience is being richly rewarded.

Agreed on Santacruz Silver Blazesb. I actually just got off the phone with the CEO Arturo, and will be posting an update soon on their strong Q2, on their operations, and growth plans moving forward, so stay tuned for that.

“Clues Everywhere” for a Major Uranium Breakout: Justin Huhn

VRIC Media – August 24th, 2025

In this interview, Justin Huhn of Uranium Insider breaks down the latest developments in the uranium market, including South Korea’s surprising 8.8-million-pound tender, why its terms may go no-bid, and what that means for utilities worldwide. Huhn also unpacks U.S. nuclear policy shifts under Trump, the role of enrichment and new builds, the AI-driven electricity boom, and why supply constraints make uranium one of the most compelling commodities today.

00:00 – South Korea’s 8.8M-pound uranium tender explained

08:01 – Market signals: what utilities will learn from this

12:22 – Spot market dynamics and carry trades

16:00 – Uranium equities post–Liberation Day selloff

22:07 – U.S. executive order and nuclear buildout momentum

25:22 – Why nuclear is gaining bipartisan support

27:43 – The uranium supply/demand imbalance explained

32:09 – AI and data centers fueling electricity demand

33:33 – M&A in uranium: Paladin–Fission and what’s next

https://youtu.be/CVi9RSHgP0o